Dubai's real estate market is having another great year in 2024, with record sales and high property values. The first half of 2024 has already set the stage for one of the strongest years the market has ever seen. Over 43,000 property deals worth AED122.9 billion were made, a 30% rise from last year. Let's explore the current market trends in the Dubai property market and how they will shape the market.

Dubai Property Price Trends

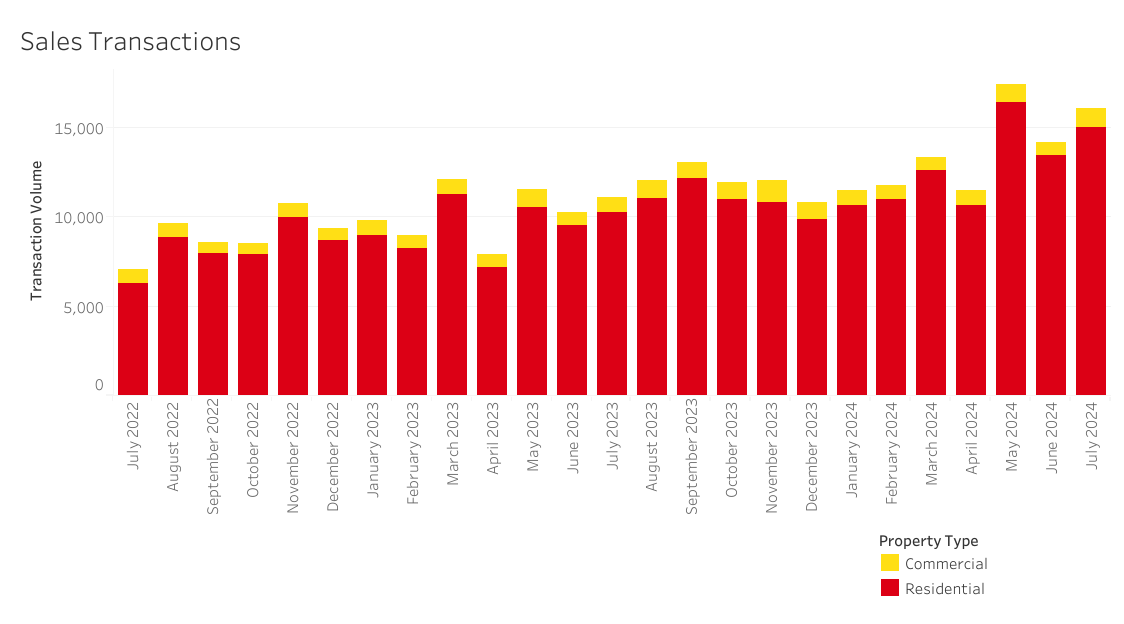

According to the Property Monitor Dynamic Price Index (DPI), the current property prices in Dubai stand at AED 1,397 per square foot on average, 13.2% higher than the previous peak in September 2014. Summer is considered an off-peak season regarding real estate transactions, but the number of property sales in July 2024 increased by 12.8%, reaching 16,113. 93.4% of these sales were of residential properties like apartments, townhouses, and villas. The average prices of these properties currently are:

Apartments: AED 1,318,880

Villas: AED 2,855,150

Townhouses: AED 8,176,000

The remaining 6.6% of sales transactions were of commercial properties, with hotel apartments, office spaces, and vacant lands being the top priorities.

Source: Property Monitor

Luxury homes in Dubai are very popular right now, thanks to expats looking for high-end properties. Areas like Emirates Hills, Palm Jumeirah, and Jumeirah Bay Island are seeing more interest. Developers are meeting this demand by building luxurious villas, penthouses, and branded residences with top-notch amenities and personalised services.

Dominance of Off-Plan Properties

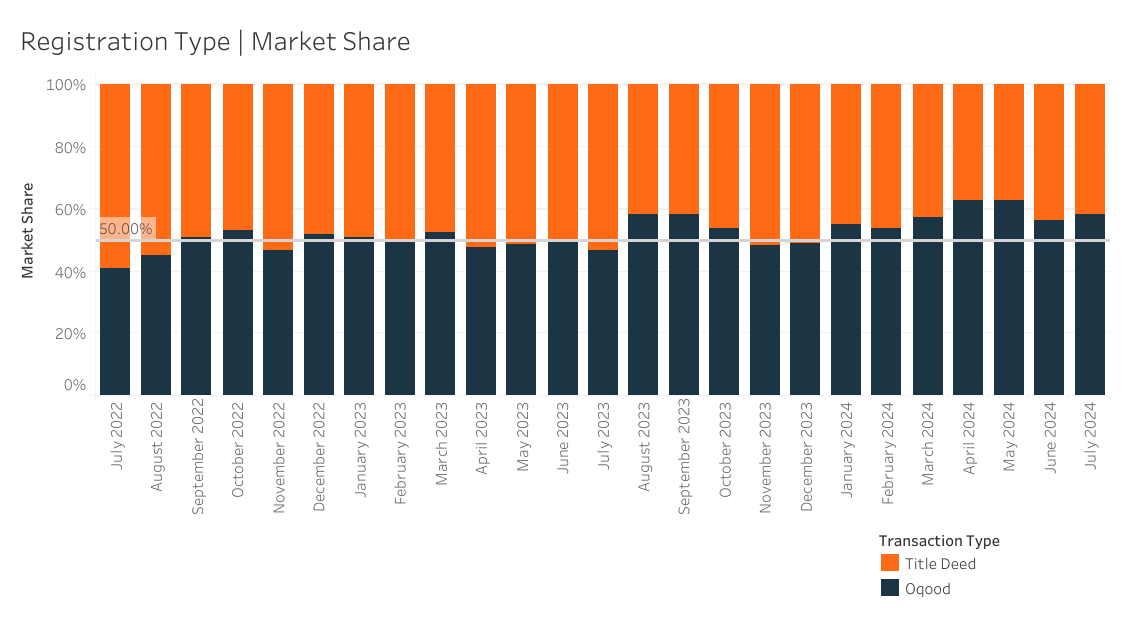

In July, 9,393 off-plan property sales (Oqood transactions) were recorded, 17.1% more than the previous month. These sales now make up 67.1% of the market. At the same time, sales of completed properties (with Title Deeds) also increased by 7.2%, making up 41.7% of all transactions.

Source: Property Monitor

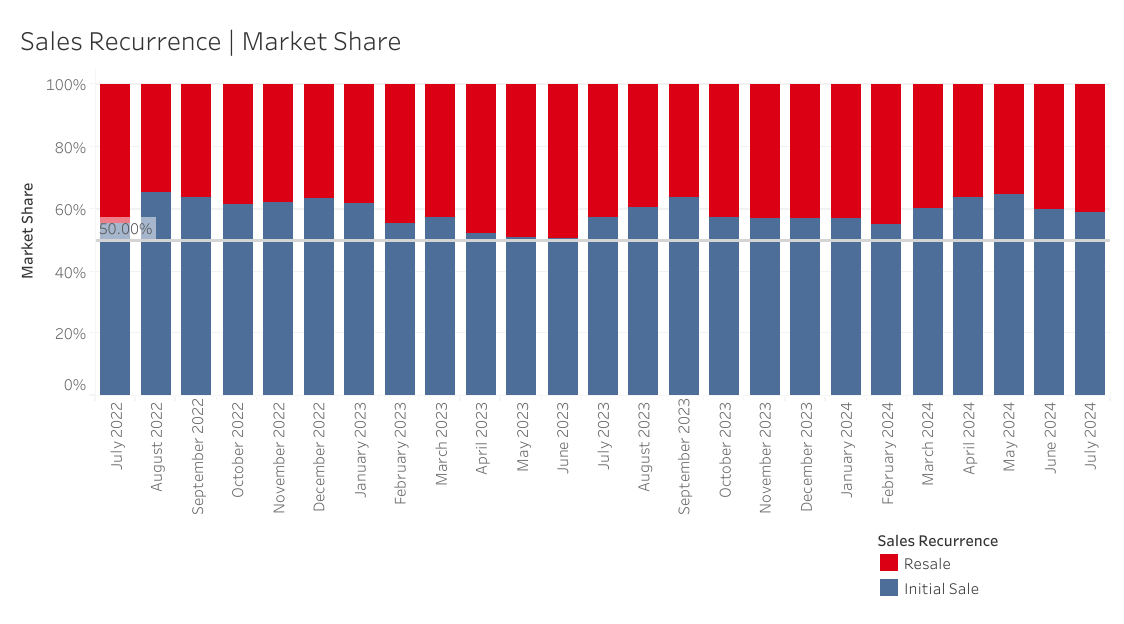

In July, resales of properties (homes sold after their initial purchase from the developer) were 6,612, making up 41% of the market. This was a slight increase from the previous month. Of these resales, 25.6% were off-plan (properties sold before completion), pushing the average for the past year to a record high of 23.8%.

Source: Property Monitor

In addition, nearly 9,000 new off-plan units were added to the market in July, bringing the total to a record about 68,000 units across more than 220 projects this year. The off-plan market is booming and is on track to exceed last year's total of around 96,000 units.

Investors are still interested in off-plan properties because they are usually cheaper and offer flexible payment options. Developers are introducing new off-plan projects with appealing deals like payment plans starting after the property is handed over and waiving Dubai Land Department fees. This trend is especially noticeable in new and growing areas like Dubai Creek Harbour, Mohammed Bin Rashid City, and Dubai Hills Estate.

Rising Number of Mortgages

In July, mortgage transactions jumped by 20.2%, reaching 4,033 loans. Of these loans, 53% were for new home purchases, with an average loan amount of AED 1,830,000 and a loan-to-value ratio of 76.7%. Loans for refinancing or accessing home equity increased to 33.8% of the total, while loans for bulk purchases by developers and large investors made up 13.2%, a drop from the previous month. There were 534 bulk loans issued in July, mostly for projects like Platinum Tower in Jumeirah Lake Towers, Paradise Views 1 in Majan, and Al Ayyan Tower in International City II.

Mortgage volumes are expected to remain steady, though there might be a slight drop as we approach the fourth quarter. This drop could be temporary as people might be waiting for interest rates to drop. If rates decrease, which could start as early as the next US Federal Reserve meeting in September, we expect to see even more refinancing activity.

Self-Sustained Urban Communities

Dubai property market trends focus on developing complete communities where people can meet all their daily needs. Most residents prefer living in areas with infrastructure like schools, clinics, shops, and gyms nearby. Following these trends, top developers now focus on building entire neighbourhoods instead of individual residential buildings. They include kindergartens, schools, healthcare services, shopping centres, and gyms. They offer residents more than just a place to live.

What to Expect in 2024

In 2024, Dubai's real estate market has been incredibly active, with record-high monthly transactions. The market is set to exceed 170,000 sales by the end of the year. This boom is mainly due to a surge in new development projects, with more off-plan launches than days in the year. Strong interest from investors and people looking for homes has led to fast sales and high absorption rates for most projects. The market should stay stable as long as these high absorption rates continue. However, high activity levels can't continue forever, and eventually, the balance between supply and demand will change.

Future of Dubai Property Market

In the coming years, the property market will see a big rise in new units, with around 41,000 expected in 2025 and 42,000 in 2026—an 80% increase compared to the 27,000 units planned for 2024. For investors, 2024 and 2025 will be important for making smart investment choices to maximise returns. The luxury market is still strong, with areas like Palm Jumeirah and Downtown Dubai attracting wealthy buyers. However, the market could face challenges, such as too much supply, which could push down rental prices. As land for top developments becomes harder to find, developers are focusing on more sustainable growth plans after 2026.

My Account

Property Management

+971 600 522233

Contact

How to: Buy in DubaiYour guide to everything you should know when buying a property in Dubai, whether you are a first time buyer or investor.Access Now

How to: Buy in DubaiYour guide to everything you should know when buying a property in Dubai, whether you are a first time buyer or investor.Access Now How to: Rent in DubaiYour guide to everything you should know when renting a property in Dubai.Access Now

How to: Rent in DubaiYour guide to everything you should know when renting a property in Dubai.Access Now CRC (Commercial Real Estate Consultants) is a market-leading real estate brokerage, affiliated with Betterhomes, specializing in commercial property sales, leasing, valuations & advisory. For more information, click below.Visit Website

CRC (Commercial Real Estate Consultants) is a market-leading real estate brokerage, affiliated with Betterhomes, specializing in commercial property sales, leasing, valuations & advisory. For more information, click below.Visit Website

Discover a curated collection of luxury properties that offer the rare, the exclusive and the extraordinary.Visit website

Discover a curated collection of luxury properties that offer the rare, the exclusive and the extraordinary.Visit website Global AffiliationLooking beyond Dubai? Discover our exclusive international listings, from luxury homes to investment opportunities worldwide. Whether you're seeking a holiday retreat or a high-yield asset, our global network connects you to the finest properties across top destinations.View now

Global AffiliationLooking beyond Dubai? Discover our exclusive international listings, from luxury homes to investment opportunities worldwide. Whether you're seeking a holiday retreat or a high-yield asset, our global network connects you to the finest properties across top destinations.View now Property ManagementRemove the hassle of property management. Our turnkey service covers all bases, from finding tenants to carrying out repairs.Get in Touch

Property ManagementRemove the hassle of property management. Our turnkey service covers all bases, from finding tenants to carrying out repairs.Get in Touch Area GuidesFrom downtown hubs to waterfront enclaves and family neighbourhoods, uncover your perfect community.View Area Guides

Area GuidesFrom downtown hubs to waterfront enclaves and family neighbourhoods, uncover your perfect community.View Area Guides